Restaurants, salons, offices, and everything deemed non-essential are closed. At the very least, walk-in traffic is severely diminished. Production and supply lines are halted or critically damaged. Billings for your products or services have stopped. New sales are hurting, clients or customers have been lost, and crucial accounts receivables are delayed or worse, they aren’t collectable at all.

Restaurants, salons, offices, and everything deemed non-essential are closed. At the very least, walk-in traffic is severely diminished. Production and supply lines are halted or critically damaged. Billings for your products or services have stopped. New sales are hurting, clients or customers have been lost, and crucial accounts receivables are delayed or worse, they aren’t collectable at all.

Things will definitely turn around; however, no one knows for sure when that will happen — which unfortunately makes it nearly impossible to plan or budget strategically.

Rather than suffer paralysis by analysis, take no action at all, or worse, take the wrong action, it’s crucial for business owners to proactively take bold initiative. It may not be easy or comfortable, but for the sake of your organization, the following critical steps must happen:

1. Change Your Attitude

The first thing to do is change your attitude. Now is the time for calm. Don’t overreact. Great leaders show an amazing calmness and focus in times of crisis. Your employees will benefit, your clients and customers will benefit, and your business will benefit from your determined, focused, and calm demeanor. Calmness doesn’t equate to actionless. On the contrary, you are about to begin taking more actions than you were yesterday, but your demeanor will affect everyone around you. Those effects need to be exceptionally positive. You must change your attitude to one of seeing this as an opportunity rather than a threat. As Ken Knorr the CEO of That! Company says: “Entrepreneurs do not achieve success by avoiding risk, but rather by seeing opportunity where others do not.”

That! Company is the word leader in White Label Digital Marketing. We deliver results for agencies large and small world-wide. Learn more about our White Label Services and what we can do for you. We can help you achieve the results you deserve today!

Now that you have it’s time to move on to the 8 remaining on the list.

2. Investigate Small Business Bailout Programs and Start the Process.

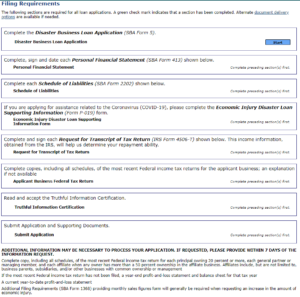

Investigate your local and state programs and economic development websites to learn how to get low-interest loans, grants and other resources that will help you pay your bills. Go immediately to the SBA Disaster Loan website and start an application. Login to every webinar and website to research the nuts and bolts of how these programs work.

Contact your relationship manager at your primary financial institution; it’s a little-known fact that many of the larger banks are SBA lenders and will help you walk through the maze of opportunities. Your goal is to track down and make claims for cash that the government is providing.

Do this as soon as possible! Be relentless about finding these opportunities—and there are plenty of them available—to help operate your business and feed your company.

3. Communicate with Your Clients and Customers

Talk to your team, clients, and customers about repositioning or creating new versions of your products or services that will meet their needs. This kind of pivoting is essential in order to remain commercially relevant and build your reputation in the marketplace. Build and develop a “what if?” or “why not?” mindset that will allow you to be openly receptive to possibilities you might not have ever considered. Creative solutions will win the day. Be open to every possibility.

Your customers want to know you are going to be here when this is over, so spend extra time reassuring them. Do not stop planning for the future. Events that are far out on the calendar can still be promoted as usual. Memorial Day sales, Labor Day sales and Black Friday promotions can still go public or be put into your consumers’ minds. This will generate confidence in your brand and not only your financial strength, but your agility as a company. Although some businesses may fail, yours will not, so share that clearly. Work in unison with the old adage, “Perception is reality.” Claim the respect you deserve while giving the comfort your clients want.

4. Revamp Your Marketing

Start right now by looking at your website. Are you open? Are you still taking orders? Are you taking appointments now, or even future appointments for after the quarantine? Regardless, you should add a banner to the top of every page of your website CLEARLY communicating the facts to your customers. You need to avoid potential confusion of whether you are open or not. You don’t need customers choosing not to do business with you because they assume you’re closed when you aren’t.

Start right now by looking at your website. Are you open? Are you still taking orders? Are you taking appointments now, or even future appointments for after the quarantine? Regardless, you should add a banner to the top of every page of your website CLEARLY communicating the facts to your customers. You need to avoid potential confusion of whether you are open or not. You don’t need customers choosing not to do business with you because they assume you’re closed when you aren’t.

Can’t ship? Why don’t you take the order anyway? Just clearly communicate to your customers that shipments are delayed but that they can “beat the rush” by placing their order now and you will ship when the quarantine or stay-at-home order is lifted.

Customer can’t come to you? Same story. Why not set the appointment anyway? Just because the quarantine may have closed your doors doesn’t mean that it needs to close your opportunities. Your competitors may not have figured this out. You can be taking and setting appointments anyway. A banner at the top of your site that says “Still taking appointments” will have people standing in line outside your doors when you reopen. So, what if you must reschedule because you predicted incorrectly? At least you’ll have a customer to reschedule![bctt tweet=”Just because the quarantine may have closed your doors doesn’t mean that it needs to close your opportunities” username=”ThatCompanycom”]

Don’t stop marketing! Change your message to reflect the new situation, but don’t stop. There is a difference between recovering and restarting. You want to recover after the quarantines end, not restart from nothing. If you have momentum, don’t let it come to a complete stop.

5. Get the Communications Open with Your Finance Department / CFO

The aforementioned disaster loans are going to require a lot of supporting documents. Business Financial Statements, Personal Financial statements, months of bank statements, proof of losses, years of tax returns. You know the drill. It’s a ton of paperwork. Start now! Get your CFO and finance team moving.

Finally, get the lines of communication with your CFO or finance team wide open. Conduct daily “touch base” meetings, if necessary. Their job, up until now, was to be off your “radar,” making decisions about bill-paying without much interaction with you. Now, you need to have up-to-the-minute numbers and forecasts. You need to know about large expenditures and maintain the ability to direct, delay, or change course. Do not let finance run on autopilot.

Think about the future, make sure your potential customer pipeline is full. Cut everything that can be cut but don’t cut your own throat by not reaching to potential new customers or marketing to existing customers for more business.

6. Talk with Your Network

You aren’t alone. Talk to other business owners, family members, friends, and professional counselors in your relentless quest to understand, process and seek inspiration. Doing so will help you navigate this environment. Read books, listen to podcasts and watch videos about motivation. As previously mentioned, maintaining a positive attitude, being open to new ideas, and finding inspiration in the face of adversity will keep your drive high. Most importantly, turn to your faith. God will get you through this; put your stress, fears, and worries on his shoulders. You must unburden yourself of those so you have the energy to take the actions necessary.

7. Open Channels with Your Lenders, Suppliers and Landlords

Nobody likes to ask for help, but you need to start right now. Write a short email (requesting a call if necessary) asking for whatever assistance they can provide. Examples include:

- loan forgiveness

- loan deferral (i.e. no repayment period added to the end of the loan)

- interest-only terms

- longer loan amortization (time period for repayment)

- rent abatement or deferral

- discounts

- additional line of credit

You’re going to be surprised. Those you thought were immovable aren’t. Most financial institutions want you to survive this. You’re not going to find out until you ask, so ask and be bold.

8. Call your Insurance Agent

If you have business insurance, read your policy and call your agent to determine if you can file a claim for business interruption. Don’t be disappointed if you learn that in order to make a claim for business interruption you must have a claim for physical property loss. It never hurts to file the claim—do it anyway and be denied. Your insurance agent will help you do this.

9. Communicate with Your Employees

Talk to your employees. You must be honest about your challenges. In fact, you need their help to overcome them. You need employees to help you identify inefficiencies, control unnecessary expenditures and share where costs can be trimmed or cut completely.

Further, your employees that are underutilized need to be immediately refocused into tasks that can help with marketing. Look for opportunities to re-purpose underutilized employees. Content development, organic messaging, outreach campaigns, there are always numerous tasks of value to complete.

It’s hard to lay people off, but it may be necessary in order to reduce payroll when there’s insufficient revenue coming in. Remember, you may not be able to keep everyone from experiencing loss at this time. Your most important mission is to ensure that your company CAN and WILL come out the other side, intact. Remain positive and provide reassurances that if you must conduct layoff’s that your intent would be to re-hire as many employees as possible. Offer to help your employees research available government resources and recommend that they apply for unemployment benefits immediately.

Start now! The steps above are not sequential, but rather can happen in parallel. Change your attitude, remain calm, and get moving. Remember—this is an opportunity.

Talk With Us

Talk With Us  Give Some Love

Give Some Love